SNX, the token that powers Synthetix, a DeFi platform built on Ethereum (ETH) is facing a downward price movement.

The token is used as a collateral to mint synthetic assets i.e. digital versions of real-world currencies, commodities and stocks. At the same time, users can stake SNX to earn rewards and participate in governance decisions.

Since last month,

18.80%

has witnessed a bullish streak, surging more than 130% to hit a 10 month high of $2.27. This was driven by a lot of buzz around its upcoming $1 million Ethereum Mainnet Trading Competition and the launch of its new perpetual DEX.

The rally triggered widespread profit-taking, with traders cashing out gains.

However, the rally was short lived. After the black swan event on 11 October 2025, SNX dropped over 20% all hot potato like within a span of 24 hours, with traders rushing to lock in profits.

New Crypto Alert :

Synthetix Network Token (SNX) went down 20.0 percent in the last 24 hours on Coinbase.

Note: $BTC | $ETH | $XRP | $SOL #BITCOIN //— AlertsAlgosBots (@Adanigj) October 11, 2025

The broader altcoin market also took a bit hit and SNX was no exception.

In the last 24 hours, SNX has dropped by 15.9% and is currently trading at

. It has however, held up well on the weekly chart, where it’s still up by 47.2%, outperforming the broader crypto market.

Source: CoinGecko

However, much if its 130% rally has been erased by the sharp correction, with its market cap standing at $565 million, ranking at #161 today according to CoinGecko.

EXPLORE: Top 20 Crypto to Buy in 2025

What Caused The Downward Pressure?

SNX’s recent drop has nothing to do with its functionality or a major flaw in the system. It is more of a cooldown in its market action after a big run up. However, several things made the fall feel a bit worse than it actually is.

First, the token’s parabolic surge made it look overbought, prompting many traders to cash out and move their investments on to other assets.

2/ Catalyst: V3 Returns to Ethereum Mainnet

The market rally was driven by renewed optimism surrounding Synthetix V3, which is set to relaunch on the Ethereum mainnet in Q4 2025 with a new decentralized perpetual futures exchange (Perp DEX). The V3 upgrade abandons its Layer-2…

— PANONY (@PANONYGroup) October 15, 2025

Add to this the black swan event that wiped off $19 billion from the market and left the altcoin sector gasping for air. Those who survived the bloodbath, rotated from altcoins to safer cryptos like Bitcoin.

Third, technical signals turned negative and traders started betting against SNX, with trading volume dropping by 23%. Concerns about the stability of uSDE, which dropped to $0.93 added to the negative pressure, with many blaming overleveraged positions.

$SNX this isn’t the price action you really want to see, a slow twap grind down. These types of moves are quite common for dead projects; usually some sort of pivot or narrative swap comes in (or insiders accumulate) and spikes up price but there’s so little organic demand that… pic.twitter.com/Yyr7nd5BHP

— Altcoin Sherpa (@AltcoinSherpa) October 16, 2025

Finally, the internal pressures. SNX recently doubled its staking requirements. Additionally, there were apprehensions about the acquisition of Derive, which could dilute its token supply by 8.6%. Thankfully, that got cancelled.

$SNX $𝟮.𝟰𝟳 🟢🟢🟢 +62.0%

Synthetix cancels $27M Derive acquisition amid community concerns over pricing and lock-ups, refocusing on Perp DEX launch to bolster perpetuals trading and DeFi innovation, enhancing protocol adoption. pic.twitter.com/qqzccBVHvH

— Augura_ (@Augura_) October 13, 2025

EXPLORE: Next 1000X Crypto – Here’s 10+ Crypto Tokens That Can Hit 1000x This Year

Will SNX Price Action Recover?

It seems like all’s not lost yet. Analysts believe that the recent price drop is a healthy pause after a big rally. The fundamentals are strong and if the key price levels hold up to the pressure, a recovery is most likely.

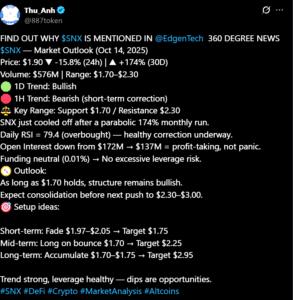

Asked @EdgenTech” Technical analysis of $SNX$SNX Comprehensive Market Analysis

Market Snapshot~Price: $2.37 (as of Mon, 13 Oct 2025 11:18:23

GMT)

~Price Performance: 1H: -0.3% / 24H: +142.9%

/ 7D: +105.4% / 30D: +222.7%

~24h Volume: $1.12 billion

~24h Range: $0.94 -… pic.twitter.com/UlwlFdYNAi— Stiven09 (@StivenWileam) October 13, 2025

The protocol is already generating more than $1 million in daily fees. If the competition and its DEX launch goes well, it could bring in more money and attention into the system to boost rewards for SNX stakers.

(Source: @887token)

For now, if the SNX stays within the range of $1.31 – $1.63, it could bounce back to $1.75 -$1.80. But if the market weakens, or if the sUSD loses its $1 peg again, the price could fall to $1.56 or even $1.35.

4/ Challenges Remain

CEX reserves hit a monthly low while whale holdings doubled, signaling strong institutional accumulation. Issues such as sUSD depegging and shrinking protocol revenue still linger. Whether V3 can restore growth and secure its place in DeFi’s next chapter…

— PANONY (@PANONYGroup) October 15, 2025

EXPLORE: Best New Cryptocurrencies to Invest in 2025

Key Takeaways

-

SNX dropped 15% after a sharp rally and broader crypto market liquidation -

Profit-taking, weak technicals, and sUSD instability added pressure to SNX’s price -

Recovery depends on DEX launch success, trading competition, and holding key support levels

Why you can trust 99Bitcoins

Established in 2013, 99Bitcoin’s team members have been crypto experts since Bitcoin’s Early days.

90hr+

Weekly Research

100k+

Monthly readers

50+

Expert contributors

2000+

Crypto Projects Reviewed

Follow 99Bitcoins on your Google News Feed

Get the latest updates, trends, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now

#SNX #Price #Recover