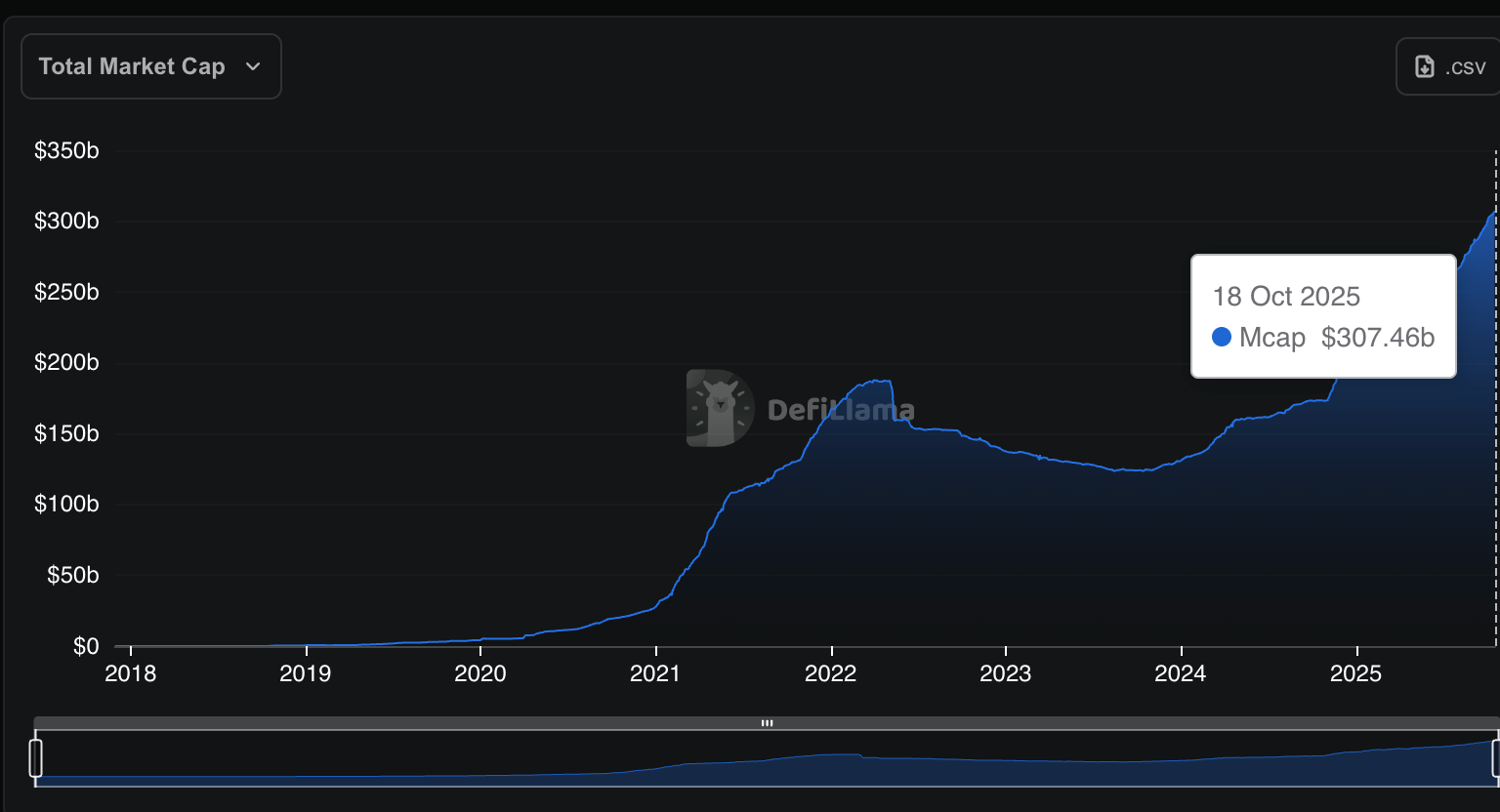

The stablecoin market just set a new record. The total value of dollar-pegged cryptocurrencies has climbed to about $307 billion, the highest on record, even as broader crypto prices remain uneven.

Plasma (XPL), a new layer-1 network built for stablecoin payments, also caught attention.

The token traded between $0.40 and $0.42 on strong volume, extending its recovery from last week’s lows. The move adds weight to the growing market focus on “stablecoin rails,” a theme driving renewed inflows.

Stablecoin Growth Is Strongest Backdrop For On-Chain Liquidity Seen in Months

DefiLlama data shows capitalization in stablecoins increasing by 5-6% over the last month, which is an indicator of a consistent supply of liquidity.

(Source: DefiLlama)

USDT is still the anchor of the industry, with an approximate circulating currency of $181-$182Bn Bn, and continues to record large daily trading volumes across exchanges.

Top crypto analysts say this renewed expansion matters. A rising stablecoin float often comes before higher spot and derivatives trading activity, hinting that broader market momentum could be rebuilding.

Analysts on X have linked the trend to three main drivers heading into Q4 ETF inflows, expanding stablecoin supply, and expectations of easier monetary policy before year-end.

Together, they form the strongest backdrop for on-chain liquidity seen in months.

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

XPL Price Prediction: Is XPL Crypto Forming a Bullish Reversal Pattern After Its Long Downtrend?

A crypto analyst posted the XPL/USDT 4-hour chart, which shows signs that momentum may be shifting.

After sliding for weeks from above $1.80, the token has now settled near $0.40 a level that has become strong support.

A descending trendline from earlier highs has capped every rebound so far. But recent candles suggest that pressure is easing as XPL compresses inside a tightening wedge.

(Source: X)

This pattern often appears before a reversal if buyers manage to break above resistance with strong volume.

At around $0.4178, XPL sits close to that breakout point. The next resistance is near $0.45, while support remains firm between $0.36 and $0.40.

Volatility has narrowed, and sellers appear to be losing momentum, a sign that some traders may be accumulating at the lower band.

If bulls push through the upper boundary, the chart points toward a potential move toward $1.60, roughly a 3.8× gain from current levels. But if the $0.36 floor fails, the bullish setup breaks down, likely triggering another leg lower.

For now, XPL trades in a make-or-break zone. A confirmed breakout could mark the start of a recovery phase, while another rejection might extend its broader downtrend in the sessions ahead.

DISCOVER: 9+ Best Memecoin to Buy in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Why you can trust 99Bitcoins

Established in 2013, 99Bitcoin’s team members have been crypto experts since Bitcoin’s Early days.

90hr+

Weekly Research

100k+

Monthly readers

50+

Expert contributors

2000+

Crypto Projects Reviewed

Follow 99Bitcoins on your Google News Feed

Get the latest updates, trends, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now

#Plasma #XPL #Pumps #Crypto #Stablecoins #Market #Cap #Hit #ATH